DEF 14A: Definitive proxy statements

Published on April 14, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒Filed by a party other than the Registrant ☐

Check the appropriate box:

☐Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material Pursuant to § 240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒No fee required.

☐Fee paid previously with preliminary materials.

☐Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

SEI Investments Company

Notice of Annual Meeting of Shareholders

to be held May 28, 2025

|

|

Capitalizing | |

on opportunity.

| |

1 2025 Proxy Statement

Alfred P. West, Jr.

Executive Chairman

|

SEI achieved significant milestones in 2024 with record revenue, net

sales events, operating income, and earnings per share. At the heart of

this success is the steadfast dedication of our leadership and talented

workforce to delivering for our clients and executing our growth

strategy.

Our company’s evolution reinforces our focus on an enterprise mindset

that leverages the breadth of SEI’s technology, operations, and asset

management capabilities across the markets we serve. We are investing

in the areas of our business that we believe can deliver the greatest

return on investment. We are optimizing our operating model, aligning

capital and functions to execute our vision for growth and maximize

enterprise value added. And we are committed to innovation that can

accelerate that growth.

Our people are SEI, and our company’s values are not only the

foundation of our culture, but they also enable our success. Nurturing

an environment and culture that unites our colleagues in a shared

purpose is central to capitalizing on the opportunities ahead.

We are looking to what’s beyond the horizon and reimagining what’s

possible. What we do today is through the lens of what’s next, so we

can drive growth for our clients, the industry, and our shareholders.

|

2 2025 Proxy Statement

Notice of Annual Meeting

of Shareholders

| ||

Date and time

Wednesday, May 28, 2025

9 a.m. ET

Location

Virtual meeting

Our 2025 Annual Meeting will be held

in a virtual-only format. Shareholders

will not be able to attend our 2025

Annual Meeting of Shareholders in

person.

Shareholders may attend our 2025

Annual Meeting of Shareholders

virtually at

www.virtualshareholdermeeting.com

/SEIC2025 by entering the 16-digit

voting control number found on your

proxy card or in your voting

instructions.

Join our

virtual

shareholder

meeting

|

Purposes

1.To elect three directors for a term expiring

at our 2028 Annual Meeting of Shareholders;

2.To approve on an advisory basis the

compensation of our named executive

officers;

3.To ratify the appointment of KPMG LLP as

independent registered public accountants

to examine our consolidated financial

statements for 2025; and

4.To transact such other business as may

properly come before our 2025 Annual

Meeting of Shareholders or any adjournments

thereof.

Only shareholders of record at the close of business on

March 20, 2025 will be entitled to receive notice of, and to

vote at, our 2025 Annual Meeting of Shareholders and any

adjournments thereof. Additional information regarding the

rules and procedures for participating in and voting during

the Annual Meeting will be set forth in our meeting rules of

conduct, which shareholders will be able to view prior to or

during the virtual meeting.

Whether or not shareholders plan to attend our virtual-only

2025 Annual Meeting of Shareholders, SEI urges shareholders

to vote and submit their proxies in advance of the meeting

by one of the methods described in these proxy materials.

By order of the Board of Directors,

Michael N. Peterson, Secretary

April 14, 2025

|

|

3 2025 Proxy Statement

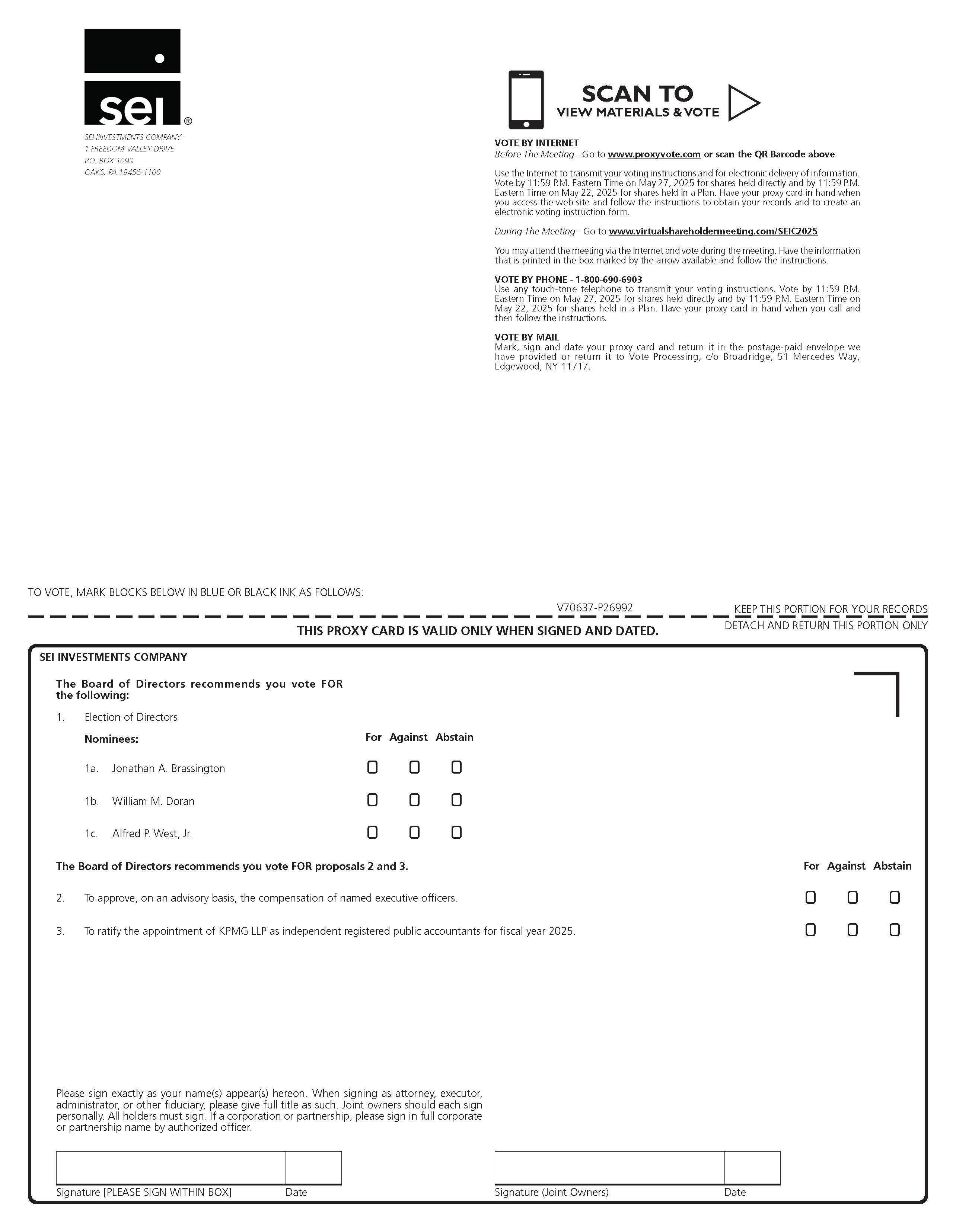

How to vote |

|||

Your vote is

important

Vote by 11:59 p.m. ET on

May 27, 2025 for shares held

directly and by 11:59 p.m. ET

on May 22, 2025 for shares

held in a Plan. Refer to the

attached proxy materials or

the information forwarded by

your bank, broker, or other

nominee to see which voting

methods are available.

|

Internet

Go to www.proxyvote.com and follow the instructions. You

will need the control number from your proxy card or voting

instruction form, or to scan the QR code to vote using your

mobile device.

Telephone

If your shares are held in the name of a broker, bank or

other nominee, follow the telephone voting instructions

provided. If your shares are registered in your name, call

1-800-690-6903 and follow the voice prompts. You will

need the control number from your proxy card or voting

instruction form.

Mail

Complete, sign, date, and return the enclosed proxy card or

voting instruction card in the postage pre-paid envelope

provided.

Voting at the Annual Meeting

This year’s Annual Meeting will be virtual. You may vote

during the meeting pursuant to the rules and procedures for

participating in and voting during the meeting set forth in

our meeting rules of conduct, which shareholders will be

able to view prior to or during the meeting at

www.virtualshareholdermeeting.com/SEIC2025 by entering

the 16-digit voting control number found on your proxy card

or voting instruction form and by following the instructions

to vote.

Please read both this Proxy Statement and our Annual

Report before you cast your vote. They are available free

of charge on our website at seic.com/investor-relations.

|

||

4 2025 Proxy Statement

Table of contents |

|||||

About SEI |

|||||

Capitalizing on opportunity |

|||||

Proposal 3 |

|||||

Annex A: Reconciliation of GAAP to Non-GAAP

Measure

|

|||||

Annex B: Employee Demographics |

|||||

5 2025 Proxy Statement

Proxy

statement.

This Proxy Statement is furnished in connection with the solicitation by the Board of

Directors (the “Board”) of SEI Investments Company (“SEI,” “the Company,” “we,”

or “our”) of proxies for use at our 2025 Annual Meeting of Shareholders to be held

on May 28, 2025, and at any adjournments thereof (our “2025 Annual Meeting”).

2025 Annual Meeting of

Shareholders

Action will be taken at our 2025 Annual Meeting to

elect three directors with a term expiring at our

2028 Annual Meeting of Shareholders; to approve

on an advisory basis the compensation of our

named executive officers; to ratify the

appointment of KPMG LLP as independent

registered public accountants to examine our

consolidated financial statements for 2025; and to

consider such other business as may properly come

before our 2025 Annual Meeting and any

adjournments thereof. This Proxy Statement, the

accompanying proxy card or voting instruction form

and our Annual Report for 2024 will be sent to our

shareholders on or about April 14, 2025.

Our 2025 Annual Meeting will be held in a virtual-

only format. Shareholders will not be able to

attend our 2025 Annual Meeting in person.

Shareholders may attend our 2025 Annual Meeting

virtually at www.virtualshareholdermeeting.com/

SEIC2025 by entering the 16-digit voting control

number found on your proxy card or your voting

instruction form. Shareholders whose shares are

held in the name of a broker, bank or other

nominee and who need their 16-digit control

number should contact their bank, broker or other

nominee, and to ensure receipt of the control

number in a timely fashion, should do so well in

advance of the 2025 Annual Meeting of

Shareholders.

Voting at the meeting

Only the holders of shares of our common stock,

par value $.01 per share (“Shares”), of record at

the close of business on March 20, 2025

(“Shareholders”), are entitled to vote at our 2025

Annual Meeting. On that date, there were

125,744,605 Shares outstanding and entitled to be

voted at our 2025 Annual Meeting. Each

Shareholder will have the right to one vote for

each Share outstanding in his or her name on our

books.

See “Ownership of Shares” for information

regarding the ownership of Shares by our directors,

nominees, officers, and certain shareholders.

Quorum and required votes

A majority of the Shares entitled to vote at the

2025 Annual Meeting, present either in person or by

proxy, will constitute a quorum for all purposes of

the 2025 Annual Meeting. Shares voted on any

matter submitted to a vote at the Annual Meeting,

under Pennsylvania law, will be considered present

for all purposes of the meeting and will therefore

be counted for purposes of calculating whether a

quorum is present at the Annual Meeting. Under

Pennsylvania law and our Articles and Bylaws, if a

quorum is present at the meeting:

•the three nominees for election as directors will

be elected to the Board if the votes cast for each

nominee exceed the votes cast against the

nominee;

•management’s proposal to approve on an

advisory basis the compensation of our named

6 2025 Proxy Statement

executive officers as disclosed in this Proxy

Statement will be approved if the votes cast in

favor of the proposal constitute a majority of the

votes which all shareholders present in person or

by proxy are entitled to cast; and

•the ratification of the appointment of our

independent public accountants will be approved

if the votes cast in favor of the proposal

constitute a majority of the votes which all

shareholders present in person or by proxy are

entitled to cast.

Abstentions are considered votes entitled to be

cast on a proposal, but not cast. Therefore,

abstentions will have no effect on the election of

directors, but will impact the other proposals as

they will have the effect of a vote against the

proposal. Broker non-votes, which occur solely

with respect to “non-routine” matters such as the

election of directors or the advisory vote on

compensation, are considered not entitled to be

cast on those matters. Thus, broker non-votes will

have no effect on any of the proposals.

Other voting information

Shares represented by each properly executed

proxy card will be voted in the manner specified by

the respective Shareholder. If instructions to the

contrary are not given, such Shares will be voted

FOR the election to our Board of the nominees

listed herein; FOR management’s proposal to

approve on an advisory basis the compensation of

our named executive officers; and FOR the

ratification of the appointment of KPMG LLP as

independent registered public accountants to

examine our consolidated financial statements for

2025.

If any other matters are properly presented for

action at the meeting, the proxy holders will vote

the proxies (which confer discretionary authority

to vote on such matters) in accordance with their

best judgment. Brokers or other nominees who

hold Shares for a beneficial owner have the

discretion to vote on routine proposals when they

have not received voting instructions from the

beneficial owner at least ten days prior to the

Annual Meeting.

Your broker is not permitted to vote on your behalf

on the election of directors or the advisory vote

proposal on approval of compensation, as well as

any other non-routine matters unless you provide

specific instructions by completing and returning

the proxy card or by following the instructions

provided to you by your broker, trustee or nominee

to vote your Shares via telephone or the Internet.

We expect that brokers and nominees will

determine that they have the discretion to vote

the Shares held of record by them in the absence

of voting instructions from the beneficial holder

only on the ratification of the selection of our

independent public accountants.

As a result, it is important to understand that if

you hold your Shares through a broker, you must

give your broker specific instructions on how to

vote your Shares for them to be counted as votes

cast on a number of matters being considered at

the meeting and to affect the outcome of those

votes.

You may vote your Shares in one of several ways,

depending upon how you own your Shares. If you

own shares registered in the name of a bank,

broker or other nominee, refer to your proxy card

or voting instruction form to see which voting

methods are available to you. If you own shares

that are registered with our transfer agent in your

own name, you may vote on the Internet, by

telephone or mail as described on your ballot card

or voting instruction form.

This year’s annual meeting will be virtual. You may

vote during the meeting pursuant to the rules and

procedures for participating in and voting during

the Annual Meeting set forth in our meeting rules

of conduct, which shareholders will be able to view

prior to or during the meeting at

www.virtualshareholdermeeting.com/SEIC2025 by

entering the 16-digit voting control number found

on your proxy card or your voting instruction form,

and by following the instructions to vote.

Any record Shareholder giving a proxy or other

voting instruction has the right to revoke it by

providing written notice of revocation to our

Secretary at any time before the proxy or voting

instruction is voted.

Please read both this Proxy Statement and our

Annual Report before you cast your vote.

7 2025 Proxy Statement

About SEI.

SEI is a leading global provider of financial technology, operations, and asset

management services within the financial services industry. We tailor our solutions

and services to help clients more effectively deploy their capital—whether that’s

money, time, or talent—so they can better serve their clients and achieve their

growth objectives.

8 2025 Proxy Statement

Capitalizing on

opportunity.

Competitive advantage.

With our core competency pillars of technology, operations, and asset management,

the breadth of the markets we serve and capabilities across investment processing,

investment operations, and investment management uniquely position us in the

financial services industry. We deliver our services standalone or combine multiple

capabilities into comprehensive solutions designed to meet the needs of each

market we serve globally. Our clients include wealth managers, banks, investment

advisors, asset managers, family offices, institutional investors, and ultra-high-net-

worth investors.

Technology and operations

•End-to-end platforms and technology

infrastructure

•Custody/sub-custody processing

•Investment processing platforms in SaaS or

PaaS models

•Cybersecurity, regulatory, and compliance

services

Asset management

•Suite of internally managed and third-party

investment products

•Manager research, asset allocation, and

portfolio construction

•Direct indexing, factor-based strategies,

alternatives, and tax management

•Discretionary investment management

9 2025 Proxy Statement

2024 performance highlights.**

In many aspects, 2024 was a record year for our company. SEI’s total revenue,

operating income, and earnings per share reached record levels for the year and

demonstrated strong growth over 2023. Net sales events, which measures the value

of new business wins less business losses, also reached a record, reflecting

significant improvement in our overall business momentum. These results were

achieved while maintaining a fortress balance sheet and returning approximately

$620 million of capital to shareholders.

10 2025 Proxy Statement

Our values. |

|||

We’re guided by six core values that help us grow and defy the status quo. They

are woven in to the fabric of the culture and workplace we nurture and serve as

the standards of our employees’ visible actions each day.

| |||

|

|

||

Courage |

Integrity |

||

|

|

||

Collaboration |

Inclusion |

||

|

|

||

Connection |

Fun |

||

11 2025 Proxy Statement

Proxy

Summary.

Annual Meeting of Shareholders

|

|||||

DATE AND TIME

May 28, 2025 at 9 a.m. ET

LOCATION

www.virtualshareholdermeet

ing.com/SEIC2025

RECORD DATE

March 20, 2025

|

|||||

Voting matters

Shareholders will be asked to vote on the following matters at the Annual Meeting. We

encourage you to read the entire Proxy Statement before voting.

|

|||||

PROPOSAL |

BOARD

RECOMMENDATION

|

PAGE |

|||

1. To elect three directors for a term expiring at our

2028 Annual Meeting of Shareholders

Our Board unanimously recommends that Shareholders vote FOR the election of Mr.

Jonathan A. Brassington, Mr. William M. Doran and Mr. Alfred P. West, Jr. to the class

of directors whose term will expire at our 2028 Annual Meeting of Shareholders.

|

|

Vote FOR

each

director

nominee

|

|||

2. To approve on an advisory basis the compensation of

our named executive officers

Our Board seeks a non-binding advisory vote from our Shareholders to approve the

compensation of the named executive officers as disclosed in this Proxy Statement.

Our Board and our Compensation Committee value the opinions of our Shareholders. To

the extent that there is any significant vote against the compensation of our named

executive officers, we will consider our Shareholders’ concerns, and the Compensation

Committee will evaluate whether any actions are necessary to address those concerns.

|

|

Vote FOR |

|||

3. To ratify the appointment of KPMG LLP as

independent registered public accountants to examine

our consolidated financial statements for 2025

The Audit Committee of our Board has selected KPMG LLP (“KPMG”) as our

independent registered public accounting firm to audit our consolidated financial

statements for the fiscal year ending December 31, 2025. The Audit Committee and the

Board seek to have the Shareholders ratify the appointment of KPMG by the Audit

Committee.

|

|

Vote FOR |

|||

12 2025 Proxy Statement

Proposal 1

Election

of Directors.

Our Board unanimously recommends that Shareholders vote FOR the election of

Mr. Jonathan A. Brassington, Mr. William M. Doran, and Mr. Alfred P. West, Jr. to

the class of directors whose term will expire at our 2028 Annual Meeting of

Shareholders.

13 2025 Proxy Statement

|

Required vote and Board

recommendation

|

||

Our Board currently consists of eight members

and is divided into three classes comprised of

three directors in two of the classes and two

directors in the other class. One class is elected

each year to hold office for a three-year term

and until successors of such class are duly elected

and qualified, except in the event of death,

resignation, or removal of a director. At our 2025

Annual Meeting, Shareholders will be asked to

vote upon the election of three nominees to the

class of directors whose term will expire at our

2028 Annual Meeting of Shareholders.

Shares represented by properly executed proxy

cards in the accompanying form will be voted for

such nominees in the absence of instructions to

the contrary.

Under our Bylaws, directors must be elected by a

majority of votes cast in uncontested elections.

This means that the number of votes cast “for” a

director nominee must exceed the number of

votes cast “against” the nominee. In contested

elections, the vote standard would be a plurality

of votes cast. Our Bylaws provide that, in an

uncontested election, each director nominee who

is an incumbent director must submit to the

Board before the annual meeting a letter of

resignation that is conditioned on not receiving a

majority of the votes cast at the annual meeting.

Should a candidate not receive a majority of the

votes cast at the meeting, his or her resignation

is tendered to the independent directors of the

Board for a determination of whether or not to

accept the resignation. The Board’s decision and

the basis for the decision would be disclosed

within 90 days following the certification of the

final vote results.

|

The Board, following the recommendation of the

Board’s Nominating and Governance Committee

and following the nominating process described

under the caption “Corporate Governance-

Nominating Process” elsewhere in this Proxy

Statement, has nominated Jonathan A.

Brassington, William M. Doran, and Alfred P.

West, Jr. for election at our 2025 Annual Meeting.

Each of the nominees are incumbent directors,

have consented to be named and to serve if

elected, and have provided the Board the

conditional letter of resignation that is required

under our Bylaws. We do not know of anything

that would preclude these nominees from serving

if elected. If, for any reason, a nominee should

become unable or unwilling to stand for election

as a director, either the Shares represented by all

proxies authorizing votes for such nominee will be

voted for the election of such other person as our

Board may recommend, or the number of

directors to be elected at our 2025 Annual

Meeting will be reduced accordingly.

Set forth below is certain information concerning

Mr. Brassington, Mr. Doran, Mr. West and each of

the five other current directors whose terms

continue after our 2025 Annual Meeting. In

determining to nominate the nominees for

election to the Board, as well in considering the

continued service of the other members of our

Board, our Board has considered the specific

experiences and attributes of each director listed

below, and based on their direct personal

experience, the insight and collegiality that each

of the nominees and continuing directors brings

to board deliberations.

|

||

14 2025 Proxy Statement

Nominees for election at our 2025

Annual Meeting of Shareholders with

terms expiring in 2028:

|

Jonathan A. Brassington |

Partner, NewSpring Capital / Age: 50 / Director since: April 2022

Since March 2024, Mr. Brassington is a Partner at NewSpring Capital, where he

focuses on investing growth capital in software and technology-enabled business.

From 2020 until May 2023, Mr. Brassington led Capgemini’s Digital Customer

Experience (DCX) business in North America, focusing on DCX transformation for

Global 1000 clients. From March 2018 until December 2019, he led Capgemini

Invent in North America, the management consulting division of Capgemini, Inc.

Prior to Capgemini, Mr. Brassington was the CEO, Partner, and Co-founder of

LiquidHub, a digital transformation company focused on re-imagining customer

engagement.

Mr. Brassington is a member of the Board of Advisors at the University of

Pennsylvania’s School of Engineering and Applied Science. He also serves on the

Board and Executive Committee of Philadelphia Alliance for Capital and

Technology.

Qualifications

Mr. Brassington has deep expertise in the use of digital technologies to transform

the wealth management sector gained from his experience providing strategic

advisory and technology transformation services to many asset and wealth

management firms, including five of the seven largest global asset managers. He

has also advised venture and private equity firms on new and existing fintech

|

15 2025 Proxy Statement

|

William M. Doran |

Consultant; Retired Partner Morgan Lewis & Bockius LLP (Law Firm) / Age: 84

Director since: March 1985

From October 1976 to October 2003, Mr. Doran was a partner in the law firm of

Morgan, Lewis & Bockius LLP, Philadelphia, PA, a firm that provides significant legal

services to SEI, our subsidiaries and our mutual funds.

Mr. Doran is a trustee of SEI Tax Exempt Trust, SEI Daily Income Trust, SEI

Institutional Managed Trust, SEI Institutional International Trust, SEI Asset Allocation

Trust, SEI Institutional Investments Trust, SEI Catholic Values Trust, New Covenant

Funds, Adviser Managed Trust, The Advisors’ Inner Circle Fund III, Gallery Trust,

Schroder Series Trust and Schroder Global Series Trust, each of which is an

investment company for which our subsidiaries act as advisor, administrator and/or

distributor. Mr. Doran is also a director of SEI Investments Distribution Co., SEI

Investments (Asia) Limited, SEI Investments (Europe) Ltd., SEI Global Nominee Ltd.,

SEI Investments Global Fund Services Limited, SEI Investments Global, Limited, and

SEI Alpha Strategy Portfolios, L.P.

Qualifications

Mr. Doran’s legal training and experience, his relationship with the Company as

outside legal counsel for many years, and his long-standing involvement with our

Company and many of its regulated subsidiaries are valuable to his service on the

Board and as Chair of the Legal and Regulatory Oversight Committee.

|

|

Alfred P. West, Jr. |

Executive Chairman, SEI / Age: 82 / Director since: 1968

Qualifications

Mr. West has been the Executive Chairman of our Board since June 2022. Prior to

June 2022, Mr. West served as our Chief Executive Officer since our inception in

1968. Mr. West is our founder. He has provided the strategic vision in the

development of our business and solutions since our inception and his familiarity

with our customers and employees gives Mr. West insights and experience

valuable to his service on the Board.

|

16 2025 Proxy Statement

Directors continuing in office with terms

expiring in 2026:

|

Ryan P. Hicke |

Chief Executive Officer, SEI / Age: 47 / Director since: June 2022

Mr. Hicke is our Chief Executive Officer, responsible for the global business

strategy and execution for the Company across our three pillars of expertise:

investments, operations, and technology.

Mr. Hicke’s 27-year career at SEI includes 11 years in asset management and 13

years in technology across various parts of our business, with his tenure evenly

split between U.S. and global experience. Prior to being named CEO, he was our

Chief Information Officer overseeing the information technology strategy and

investment operations for the Company. Mr. Hicke also previously served as head

of our Technology Unit, as well as a Managing Director in our U.K. wealth

management business.

Mr. Hicke holds a degree in Finance from Saint Joseph’s University.

Qualifications

Mr. Hicke’s history and experience across the Company expose him to the needs

and challenges of our clients on a daily basis, while sitting on our Executive team

for many years has given him insight into strategically managing and running the

|

|

Kathryn M. McCarthy |

Independent Consultant and Financial Advisor / Age: 76

Director since: October 1998

Ms. McCarthy is an independent consultant and financial advisor to global families

and family offices. She is a director and Chairs the Audit Committee of the

Rockefeller Trust Company, NA. She serves on several family office boards as well

as investment committees and private trust company boards. From February 2000

to May 2003, Ms. McCarthy was a Managing Director at Rockefeller & Co., Inc.

Ms. McCarthy was the President of Marujupu, LLC (a New York-based family

office) from November 1996 to June 1999 and subsequently an advisor to

Marujupu, LLC on investment and wealth transfer matters. From June 1992 to

October 1996, Ms. McCarthy was a Senior Financial Counselor and portfolio

manager with Rockefeller & Co., Inc., a family office and investment manager.

Qualifications

Ms. McCarthy’s experience as a consultant and financial advisor to investors,

family offices and her wealth management experience has given her insight into

the various issues faced by the investment and wealth management business of

SEI and its clients. Ms. McCarthy serves as Lead Independent Director of the

Board.

|

17 2025 Proxy Statement

Directors continuing in office with terms

expiring in 2027:

|

Carl A. Guarino |

Former Chief Executive Officer, WizeHive, Inc. / Age: 67

Director since: September 2014

Mr. Guarino was the Chief Executive Officer of WizeHive, Inc., a SaaS company

that provides a platform for managing grants, scholarships, and employee giving

solutions, from June 2017 until WizeHive was acquired in late 2024. Mr. Guarino

was Chief Executive Officer of Procurian Inc. (a provider of procurement

outsourcing services to Fortune 1000 firms) from August 2006 until January 2014,

shortly after the acquisition of Procurian by a subsidiary of Accenture PLC. Prior

to March 2006, Mr. Guarino was Executive Vice President, Investment Advisors, of

the Company.

Qualifications

Mr. Guarino has great familiarity with the Company and its market units,

particularly the investment advisor segment, and his experience and knowledge

of the information technology industry provide the Board with a valuable

perspective on the Company’s business activities.

|

|

Stephanie D. Miller |

Former Chief Executive Officer, Hazeltree / Age: 56

Director since: October 2023

Ms. Miller was the Chief Executive Officer at Hazeltree, a leading provider of

treasury and liquidity management solutions for the asset management industry,

from October 24, 2023 to December 4, 2024. She previously served as Chief

Administrative Officer at Gilded, a Miami-based gold trading fintech. Prior to

Gilded, she was the Chief Executive Officer at Intertrust Group, a public Dutch

Euronext company, where she led the digital transformation of the client

experience and development of a robust organic and inorganic growth strategy.

Miller also held executive roles at SS&C Technologies, JP Morgan, and Citco Fund

Services.

Qualifications

With more than 25 years’ experience across financial services, she has a

combination of experience in traditional financial markets, digital assets, and

emerging markets.

|

18 2025 Proxy Statement

|

Carmen V. Romeo |

Private Investor / Age: 81 / Director since: June 1979

From December 1985 to December 2004, Mr. Romeo served as an Executive Vice

President of the Company. Mr. Romeo was our Treasurer and Chief Financial

Officer from June 1979 until September 1996. Mr. Romeo officially retired from

the Company effective December 31, 2004. Mr. Romeo was a certified public

accountant with Arthur Andersen & Co. prior to 1979.

Qualifications

In addition to his familiarity with public company accounting and financial

management issues, Mr. Romeo has great familiarity with the Company, and

particular knowledge of the Company’s business and related technology and asset

management solutions, from his previous role with the Company as the person

having managerial responsibility for the Company’s Investment Advisors business.

|

Committee memberships |

|||||

Name |

Term |

Audit |

Compensation |

Nominating and

Governance

|

Legal and

Regulatory

|

Jonathan A. Brassington (1) |

Nominee, expiring 2028 |

Member |

Member |

Member |

|

William M. Doran |

Nominee, expiring 2028 |

Chair |

|||

Alfred P. West, Jr. |

Nominee, expiring 2028 |

||||

Ryan P. Hicke |

Expiring 2026 |

||||

Kathryn M. McCarthy (1) (2) |

Expiring 2026 |

Member |

Member |

Member |

|

Carl A. Guarino (1) |

Expiring 2027 |

Member |

Chair |

Chair |

|

Stephanie D. Miller (1) |

Expiring 2027 |

Member |

Member |

||

Carmen V. Romeo (1) |

Expiring 2027 |

Chair |

Member |

Member |

|

(1) Independent Director

(2) Lead Independent Director

|

|||||

19 2025 Proxy Statement

Corporate

governance.

Governance principles and

structures

The governance principles of our Board include our

Board Nomination and Shareholder Communication

Policy, as well as the charters of our Audit

Committee, Compensation Committee, Nominating

and Governance Committee, Legal and Regulatory

Oversight Committee, and our Lead Independent

Director. Other documents which implement our

governance principles include our Code of Conduct,

our Whistleblowing, Complaints and Non-

Retaliation Policy, and our Code of Ethics for Senior

Financial Officers. Each of these documents and

various other documents embodying our governance

principles, including our Code of Conduct, are

published under the “Leadership > Governance

documents” section of the Investor Relations

portion of our website at seic.com. Amendments

and waivers of our Code of Ethics for our Senior

Financial Officers will either be posted on our

website or filed with the Securities and Exchange

Commission on a Current Report on Form 8-K.

Our Board has determined that each of Mr.

Brassington, Mr. Guarino, Ms. McCarthy, Ms. Miller,

and Mr. Romeo is an “independent director” as

such term is defined in Rule 5605(a)(2)

promulgated by The NASDAQ Stock Market LLC. In

this Proxy Statement, these five directors are

referred to individually as an “independent

director” and collectively as the “independent

directors.”

Mr. West, our founder and Chief Executive Officer

until June 2022, is the Executive Chairman of our

Board. The Board has concluded, in light of present

circumstances and the roles of our various Board

committees and the Lead Independent Director,

that this arrangement best suits our needs because

of Mr. West’s role as founder, strategic visionary,

and a significant shareholder.

In order to ensure that the considerations of non-

management directors are addressed at the Board,

the Board has appointed Ms. McCarthy as the Lead

Independent Director with the responsibilities and

authority set out in the Lead Independent Director

Charter. As the Lead Independent Director, Ms.

McCarthy is responsible for chairing the executive

sessions of the Board. Our independent directors

meet in regularly scheduled executive sessions

without management present.

Board and committee meetings

Our Board held nine meetings in 2024. During the

year, each director attended more than 75 percent

of the meetings of our Board and of the committees

on which he or she served. While we do not have a

specific written policy with regard to attendance of

directors at our annual meetings of shareholders,

we encourage, but do not mandate, board member

attendance at our annual meetings of shareholders,

particularly with respect to board members who

are up for election at that annual meeting. All of

our directors who were members of the Board at

that time attended our 2024 Annual Meeting of

Shareholders.

The standing committees of our Board are the Audit

Committee, the Compensation Committee, the

Nominating and Governance Committee, and the

Legal and Regulatory Oversight Committee.

Our Audit Committee held five meetings in 2024.

The principal functions of the Audit Committee,

which operates pursuant to a formal written

charter, are to assist our Board in its oversight of

the quality and integrity of our financial reporting

process, and to retain, set compensation and

retention terms for, terminate, oversee, and

evaluate the activities of our independent auditors.

The current members of the Audit Committee are

Mr. Romeo, Mr. Brassington, Mr. Guarino,

20 2025 Proxy Statement

Ms. McCarthy and Ms. Miller, each of whom is an

independent director. Our Board has determined

that Mr. Romeo is an “audit committee financial

expert” as such term is defined in Item 407(d)(5) of

Regulation S-K promulgated by the Securities and

Exchange Commission. A current copy of the

charter of the Audit Committee may be viewed on

our website at seic.com under “Investor Relations >

Leadership > Governance documents.”

Our Compensation Committee held five meetings in

2024. The principal function of the Compensation

Committee is to administer our compensation

programs, including certain stock plans and bonus

and incentive plans, as well as the salaries of senior

corporate officers and employment agreements

between us and our senior corporate officers. The

Compensation Committee members are Mr.

Guarino, Mr. Brassington and Ms. McCarthy, each of

whom is an independent director. A current copy of

the charter of the Compensation Committee may

be viewed on our website at seic.com under

“Investor Relations > Leadership > Governance

documents.” The Compensation Committee

establishes director and executive officer

compensation in accordance with the authority

granted by its charter and the Board-approved

compensation plans the Compensation Committee

administers. The Compensation Committee may

delegate its responsibilities under limited

circumstances to a subcommittee composed only of

a subset of Compensation Committee members.

Also, under the terms of the Board- and

shareholder-approved equity compensation plans,

the Compensation Committee is authorized to

provide our CEO with limited authority to make

stock-based awards to non-executive employees in

connection with recruitment, retention,

performance recognition or promotion; however,

the Compensation Committee has not authorized

our CEO to make any equity grants to our executive

officers.

Our Nominating and Governance Committee held

one meeting in 2024 to consider the nominees to

the Board for election at the 2025 Annual Meeting.

The principal function of the Nominating and

Governance Committee is to consider nominees for

election to the Board from time to time, including

recommendations submitted by our shareholders.

The members of the Nominating and Governance

Committee are Ms. McCarthy, Mr. Brassington, Mr.

Guarino and Mr. Romeo.

Our Legal and Regulatory Oversight Committee held

four meetings in 2024. The principal function of the

Legal and Regulatory Oversight Committee is to

oversee our compliance with rules and regulations

of the various regulatory bodies having jurisdiction

over our business and operations and those of our

subsidiaries.

The members of the Legal and Regulatory Oversight

Committee are Mr. Doran, Ms. Miller and Mr.

Romeo. A current copy of the charter of the Legal

and Regulatory Oversight Committee may be

viewed on our website at seic.com under “Investor

Relations > Leadership > Governance documents.”

Nominating process

Our Nominating and Governance Committee

consists solely of independent directors. Among the

responsibilities of the Nominating and Governance

Committee is the management and administration

of our Board Nomination and Shareholder

Communication Policy.

Board candidates are considered by the Nominating

and Governance Committee based on various

criteria, such as their broad-based business and

professional skills and experiences, a global

business and social perspective, concern for the

long-term interests of our shareholders, and

personal integrity and judgment. Directors are also

considered based on their diverse backgrounds and

on contributions that they can make to us, as well

as their ability to fill a current board need. In

addition, directors must have time available to

devote to activities of our Board and to enhance

their knowledge of our industry. The Board prefers

a mix of background and experience among its

members, and it uses its judgment to identify

nominees whose backgrounds, attributes and

experiences, which taken as a whole, will

contribute to insightful and robust, yet collegial,

Board deliberation. Accordingly, while there is no

exact formula, we seek to attract and retain highly

qualified directors with relevant experience who

have sufficient time to attend to their substantial

duties and responsibilities to us.

Our Nominating and Governance Committee

considers recommendations for nominations from a

wide variety of sources, including members of our

Board, business contacts, our legal counsel,

community leaders, and members of our

management. Our Nominating and Governance

Committee will also consider shareholder

recommendations for director nominees that are

received in a timely manner. Subject to compliance

with statutory or regulatory requirements, our

21 2025 Proxy Statement

Nominating and Governance Committee does not

expect that candidates recommended by

shareholders will be evaluated in a different

manner than other candidates. All such

recommendations for election of directors at the

2026 annual meeting should be submitted in writing

to our Secretary at our principal offices (1 Freedom

Valley Drive, Oaks PA 19456-1100). The Nominating

and Governance Committee Charter and the

Board’s current policy with respect to Board

Nominees and Shareholder Communications may be

viewed on our website at seic.com under “Investor

Relations > Leadership > Governance documents.”

In addition, our shareholders may nominate

candidates for election as director by soliciting

votes using their own proxy materials. See “Other

Important Information > Nominations and Proposals

by Shareholders for our 2026 Annual Meeting.”

Board Refreshment

Our Board regularly reviews its composition, skills,

and needs in the context of the Company’s overall

strategy. Our Board has concluded that directors

should not be subject to mandatory term limits

because the Board believes that the knowledge,

expertise and continuity provided by those

directors who have experience with the Company

and who continue to meet the Board membership

criteria considered by the Nominating and

Governance Committee can continue to provide

valuable guidance to the Company.

To facilitate Board refreshment, at the

recommendation of our Nominating and

Governance Committee, our Board has adopted a

retirement policy, pursuant to which no director

shall be nominated for re-election upon the

conclusion of such director’s term ending after the

director’s 75th birthday, provided that the

directors on the Board upon initial approval of the

retirement policy are not prohibited from serving

as directors through the annual meeting of the

Company’s shareholders held in 2028.

Engagement with shareholders

Our Board considers the feedback of our

shareholders as critical to our long-term success

and values the input provided when making

decisions for our company. Our discussions with

shareholders often relate to our executive

compensation program and governance matters.

During 2024, we performed an active shareholder

outreach program, engaging investors to

understand the issues that are important to them

so that management and the Board can use that

knowledge to inform our decision making and help

shape our corporate practices.

During 2024, we engaged with shareholders via

one-on-one meetings, investor conferences,

earnings calls, investor and analyst calls, on-site

investor meetings, and investor roadshows. Our

shareholder engagement team included our CEO,

CFO, the heads of our business segments and our

Head of Investor Relations.

This engagement, together with our commitment to

robust corporate governance and investor

transparency, resulted in the adoption of an

Executive Severance and Change of Control Plan

that established a consistent and quantifiable

approach to executive severance that we believe is

consistent with corporate governance best

practices. We further increased transparency into

our sales events through a quarterly disclosure of

our net recurring sales events, non-recurring sales

events, and total sales events, for each business

segment.

Shareholder communications to

our Board

Shareholders may send communications to our

Board in writing, addressed to the full Board,

individual directors, or a specific committee of our

Board, in care of our Secretary, to our principal

offices (1 Freedom Valley Drive, Oaks, PA

19456-1100). Our Board relies on our Secretary to

forward written questions or comments to the full

Board, named directors, or specific committees of

our Board, as appropriate. General comments or

inquiries from shareholders are forwarded to the

appropriate individual internally. The Board’s

current policy with respect to Board Nominees and

Shareholder Communications may be viewed on our

website at seic.com under “Investor Relations >

Leadership > Governance documents.”

Risk oversight by the Board

It is management’s responsibility to assess and

manage the various risks we face. It is the Board’s

responsibility to oversee management in this effort.

The Board has delegated aspects of their risk

management oversight responsibility to three

committees of the Board. The Audit Committee

22 2025 Proxy Statement

generally oversees risk policies related to our

financial statements and reporting. The Legal and

Regulatory Oversight Committee generally oversees

risk policies related to our compliance with legal

and regulatory obligations. The Compensation

Committee generally oversees risk policies related

to our compensation arrangements. The Board

directly considers risk matters related to our

strategic, operational, and corporate governance

matters, as well as risk that could adversely affect

our reputation.

We adopted an Enterprise Risk Management Policy

and Program based upon the COSO Enterprise Risk

Management Framework. Throughout the year, this

program is administered by our Enterprise Risk

Management team. During the year, senior

management members from across our organization

convene in our Enterprise Risk Committee on at

least a quarterly basis to discuss various aspects of

our operations that create risk for us and mitigation

strategies for these risks. At the end of each year,

our Chief Financial Officer and our General Counsel

work with our Director of Enterprise Risk

Management, internal audit department,

compliance department, risk officers of our

operations, technology and investment

management units, risk management officers of our

regulated subsidiaries, and members of our various

solutions development teams to collect, review and

prioritize business risks and mitigation measures

and responsibilities. The different identifiers of risk

include a risk assessment prepared by our

enterprise risk team; risk assessments prepared by

our internal audit team for purposes of developing

our internal audit plan; risk assessments prepared

by compliance officers for the purpose of

identifying compliance policy contents and testing

procedures; and risk assessments prepared by the

operations, technology and investment

management units for the purpose of creating and

refining their internal procedures and controls. This

group also considers the results of regulatory

examinations of our regulated subsidiaries, as well

as issues generally affecting our competitors and

the industries of which we are a part. Summaries of

these key business risks are then reviewed with our

Enterprise Risk Committee, consisting of the heads

of each of our market units and supporting

organizations.

In January of each year, the key business risk

summary is considered by a joint meeting of the

Audit Committee and the Legal and Regulatory

Oversight Committee of our Board. During the year,

our Chief Financial Officer and our General Counsel

have responsibility for escalating as appropriate

risk events and updates to the Audit Committee

and the Legal and Regulatory Oversight Committee,

respectively.

Other governance principles

The Board has also adopted a number of other

policies that directly affect governance and risk

management. These include our Compensation

Recoupment Policy and our Stock Ownership Policy,

both of which are described below under the

caption “Compensation Discussion and Analysis.”

We also have an Insider Trading Policy that governs

transactions in our securities by our directors,

officers, and employees, and promotes compliance

with the laws and rules applicable thereto. The

Insider Trading Policy is filed with our Annual

Report on Form 10-K as Exhibit 19. The Insider

Trading Policy provides that directors, executive

officers, and other employees subject to our insider

trading compliance program are not permitted to

enter into any transaction designed to hedge, or

having the effect of hedging, the economic risk of

owning out securities.

23 2025 Proxy Statement

Ownership

of shares.

The following table contains information as of March 20, 2025 (except as noted)

relating to the beneficial ownership of Shares by our Chief Executive Officer and our

Chief Financial Officer, by each of our three other most highly compensated

executive officers, by each of the members of our Board (including nominees), by all

members of our Board (including nominees) and executive officers in the aggregate,

and by the holders of five percent or more of the total Shares outstanding. As of

March 20, 2025, there were 125,744,605 Shares outstanding. Information as to the

number of Shares owned and the nature of ownership has been provided by these

persons and is not within our direct knowledge. Unless otherwise indicated, the

named persons possess sole voting and investment power with respect to the Shares

listed.

Name of Individual or

Identity of Group

|

Number of Shares

Owned (1)

|

Percentage of

Class (2)

|

Alfred P. West, Jr. (3) |

3,717,286 |

3.0 |

William M. Doran (4) |

9,174,922 |

7.3 |

Carmen V. Romeo (5) |

2,941,645 |

2.3 |

Ryan P. Hicke (6) |

364,515 |

* |

Kathryn M. McCarthy |

134,100 |

* |

Carl A. Guarino (7) |

83,257 |

* |

Jonathan A. Brassington |

8,750 |

* |

Stephanie D. Miller |

3,750 |

* |

Dennis J. McGonigle (8) |

820,625 |

* |

Michael N. Peterson |

350,000 |

* |

Philip N. McCabe |

280,759 |

* |

Sean J. Denham |

15,000 |

* |

Michael F. Lane |

21 |

* |

All executive officers and directors as a group (19 persons) (9) |

18,634,534 |

14.6 |

Loralee West (10) |

12,600,349 |

10.0 |

The Vanguard Group (11) |

11,888,519 |

9.5 |

BlackRock, Inc. (12) |

11,162,525 |

8.9 |

Loomis Sayles & Co., L.P. (13) |

8,862,150 |

7.0 |

*Less than one percent.

|

24 2025 Proxy Statement

(1)Includes shares that may be acquired upon exercise of stock options that are exercisable within 60 days of March 20, 2025

as set forth in the table below.

Name of Individual |

Number of Shares |

Alfred P. West, Jr. |

210,000 |

William M. Doran |

58,750 |

Carmen V. Romeo |

48,750 |

Ryan P. Hicke |

259,000 |

Kathryn M. McCarthy |

58,750 |

Carl A. Guarino |

58,750 |

Jonathan A. Brassington |

8,750 |

Stephanie D. Miller |

3,750 |

Dennis J. McGonigle |

226,500 |

Michael N. Peterson |

350,000 |

Philip N. McCabe |

219,000 |

(2)Applicable percentage of ownership is based on Shares outstanding on March 20, 2025. Beneficial ownership is determined

in accordance with the rules of the Securities and Exchange Commission and generally means voting or investment power

with respect to securities. Shares issuable upon the vesting of restricted stock units or the exercise of stock options that

are exercisable currently or within 60 days of March 20, 2025 are deemed outstanding and to be beneficially owned by the

person holding such units or options for purposes of computing such person’s percentage ownership, but are not deemed

outstanding for the purpose of computing the percentage ownership of any other person. Except for Shares that are held

jointly with a person’s spouse or are subject to applicable community property laws, or as indicated in the footnotes to

this table, each Shareholder identified in the table possesses sole voting and investment power with respect to all Shares

shown as beneficially owned by such Shareholder.

(3)Includes 322,500 Shares held in a trust for the benefit of Mr. Doran’s children, of which trust Mr. West is a trustee. Mr.

West disclaims beneficial ownership of the Shares held in this trust. Also includes 323,767 Shares held by the West Family

Foundation, of which Mr. West is a director and officer. Mr. West’s address is c/o SEI Investments Company, Oaks, PA

19456-1100. Mr. West has pledged as security to third parties 3,473,822 Shares, subject to adjustment. Excludes

2,459,693 Shares held by Mr. West’s wife and 10,140,656 Shares held in trusts for the benefit of Mr. West’s children (the

“Children’s Trusts”), of which trusts Mr. West’s wife is a trustee or co-trustee.

(4)Includes an aggregate of 8,408,060 Shares held in trusts for the benefit of Mr. West’s children, of which trusts Mr. Doran

is a co-trustee and, accordingly, shares voting and investment power. Mr. Doran disclaims beneficial ownership of the

Shares held in each of these trusts. Also includes 53,400 Shares held by Mr. Doran’s wife, 43,768 Shares held in the

William M. Doran 2002 Grantor Retained Annuity Trust of which Mrs. Doran is the Trustee, and 109,603 Shares held in the

William M. Doran 2004 Grantor Retained Annuity Trust. Also includes 39,430 Shares held by the Doran Family Foundation,

of which Mr. Doran is a director and, accordingly, shares voting and investment power. Of these Shares, Mr. Doran has

pledged as security to third parties 505,504 Shares, subject to adjustment.

(5)Includes 1,065,680, Shares held by the Carmen V. Romeo 2012 Children’s Trust, 243 Shares held by Mr. Romeo’s wife and

1,059,488 Shares held in the Carmen V. Romeo 2019 GST Exempt Children’s Trust.

(6)Includes 10,000 restricted stock units convertible to Shares within 60 days of March 20, 2025.

(7)Includes 12,106 Shares held by a foundation and a family trust with respect to which Mr. Guarino shares voting or

investment power.

(8)Includes 173,000 Shares held by a trust with respect to which Mr. McGonigle’s wife has sole voting power.

(9)Includes 2,168,000 Shares that may be acquired upon the vesting of restricted stock units or the exercise of stock options

exercisable within 60 days of March 20, 2025. When a Share is reportable as beneficially owned by more than one person

in the group, the ownership of the Share is only included once in the Number of Shares Owned column.

(10)Includes an aggregate of 10,140,656 Shares held in the Children’s Trusts, of which trusts Ms. West is a trustee or co-

trustee and, accordingly, shares voting and investment power. Ms. West disclaims beneficial ownership of the Shares held

in each of the Children’s Trusts. Certain of the Children’s Trusts have pledged as security to third parties 1,236,700

Shares, subject to adjustment.

(11)Based solely on the most recent amendment to Schedule 13G dated February 13, 2024 by The Vanguard Group, which has

shared dispositive power over 239,145 of the Shares indicated, shared voting power over 73,472 of the Shares indicated,

and sole dispositive power over 11,649,374 of the Shares indicated. The address of the Vanguard Group is 100 Vanguard

Blvd., Malvern, PA 19355.

(12)Based solely on the most recent amendment to Schedule 13G dated January 25, 2024 by BlackRock, Inc., which has sole

dispositive power over the number of Shares indicated and sole voting power over 10,517,673 of the Shares indicated. The

address of BlackRock, Inc. is 50 Hudson Yards, New York, NY 10001.

(13)Based solely on the most recent amendment to Schedule 13G dated February 12, 2025 by Loomis Sayles & Co., L.P., which

has sole dispositive power over the number of Shares indicated and sole voting power over 7,191,715 of the Shares

indicated. The address of Loomis Sayles & Co., L.P., is One Financial Center, Boston, MA 02111.

25 2025 Proxy Statement

Compensation

discussion and

analysis.

The following compensation discussion and analysis contains statements regarding

future individual and Company performance measures, targets and other goals.

These goals are disclosed in the limited context of our executive compensation

program and should not be understood to be statements of management’s

expectations or estimates of results or other guidance. We specifically caution

investors not to apply these statements to other contexts.

Overview

Our compensation philosophy (which is intended to

apply to all members of management, including

our Executive Chairman and our Principal

Executive Officer (“PEO”) who is our Chief

Executive Officer), as implemented by the

Compensation Committee of our Board (the

“Committee”), is to provide a compensation

program that provides competitive levels of

compensation and that emphasizes incentive

compensation plans and equity plans that are

designed to align management incentives and

behavior with attaining our annual goals and

longer-term objectives. We believe that this

approach enables us to attract, retain and reward

highly qualified personnel and helps us achieve our

tactical and strategic goals. The Committee seeks

to develop a compensation program that, overall,

the Committee believes is competitive with

compensation paid to employees with comparable

qualifications, experience and responsibilities at

companies of comparable size engaged in the same

or similar businesses as us. The Committee does

not explicitly pay any position at a specific level or

mix with reference to any particular group.

The compensation program for almost all of our

non-sales full-time employees (in addition to

benefits afforded to all employees, such as health

care insurance and stock purchase and defined

contribution plans) consists of:

•base salary; and

•incentive compensation awards pursuant to a

corporate incentive compensation plan.

Equity compensation for selected, higher-level

employees is provided by annual grants of stock

options and restricted stock units (“RSUs”).

The Committee has sought to keep base salaries at

a relatively modest portion of total compensation

for higher compensated employees, so that the

overall compensation program is more heavily

weighted toward incentive compensation in the

form of annual cash bonuses and sales

commissions, and for selected high-performing

employees:

•stock option grants that have performance

vesting requirements based on attainment of

adjusted pre-tax earnings per share (“EPS”)

targets as well as minimum time vesting periods;

and RSU grants that “cliff vest” after three

years, provided that the grantee is an employee

in good standing on the vesting date.

26 2025 Proxy Statement

The Committee has sought to include a number of

features in the compensation program that are

designed to align the interests of management

with the interests of shareholders. These features

include:

•a mixture of elements that we believe will

enable us to recruit and retain talented

employees;

•orientating the cash compensation program

elements toward incentive compensation for

those employees who are in roles that we

believe are critical to our long-term growth

prospects;

•the use of EPS targets as vesting requirements

for stock option grants in order to incent a

growth mindset in our employees;

•time vesting for our RSU grants in order to create

a longer-term view of the value of a tenured

career;

•our Stock Ownership Policy (requiring minimum

PEO 2024 Compensation

PEO 2024 Compensation

threshold shareholdings by our senior executive

officers);

Average NEO 2024 Compensation

•our Executive Severance and Change of Control

Average NEO 2024 Compensation

Plan for our senior executive officers;

•our Compensation Recoupment Policy (which

provides for claw-back of performance-based

compensation in certain instances); and

•our Insider Trading Policy (which prohibits short

sales, transactions in derivatives of our stock,

and hedging transactions).

Consistent with our pay for performance

philosophy, during 2024 approximately 90% of our

current PEO’s pay and approximately 87% of the

compensation of our other named executive

officers (“NEOs”) was paid in the form of variable

performance-based compensation, such as

incentive compensation or stock options and RSUs

(see “Summary Compensation Table”).

27 2025 Proxy Statement

Since 2012, the Committee has retained Semler

Brossy Consulting Group, LLC (“Semler Brossy” or

“Consultant”) as its executive compensation

consultant when structuring compensation plans or

engaging in comparative compensation analyses.

The Committee continued its annual engagement

activities with the Consultant during 2024 and

retained the Consultant on an advisory capacity

with respect to industry trends (See

“Compensation Consultant” below.)

When evaluating the compensation practices at

“peer group” companies for comparative purposes,

the Committee used the same cohort of companies

as was used as reference points in the

Compensation Analysis Project described in the

Proxy Statement we filed with the Securities and

Exchange Commission in connection with our 2023

Annual Meeting of Shareholders. Due to the

recency of this project, the Committee did not

believe that it was necessary to re-evaluate the

composition of the “peer group.”

At our 2024 Annual Shareholders’ Meeting, our

shareholders expressed support for the

compensation of our named executive officers

disclosed in our 2024 Proxy Statement, with 61.8%

of the votes cast voting in favor of the “Say-on-

Pay” proposal. In light of the vote in favor of our

“Say-on-Pay” being at a lower percentage than in

prior years, during 2024 our General Counsel and

Chief Financial Officer met with proxy solicitation

firms as well as a number of our shareholders to

better understand the perspective of the

constituencies for the voting recommendations and

voting choices on our 2024 Say-on-Pay advisory

resolution. One of the items of concern that was

expressed during these meetings was the amount

of severance paid to a long-standing Executive Vice

President who retired during 2023. The feedback

received during these meetings was a factor in the

Committee’s decision to adopt our Executive

Severance and Change of Control Plan for senior

executives that is discussed in greater detail below

in the “2024 Committee actions and awards”

section. When setting compensation, and in

determining our compensation policies and

practices, the Committee took into account the

results of the 2024 “Say-on-Pay” advisory

resolution to approve such executive compensation

as demonstrating support of our compensation

programs.

The Committee has also reviewed our

compensation policies as generally applicable to all

of our employees and believes that our policies,

taking into account the mitigation policies and

arrangements in place, do not encourage excessive

or unnecessary risk-taking and that any level of risk

they do encourage is not reasonably likely to have

a material adverse effect on us.

Base salary and incentive

compensation targets

The Committee seeks to recommend base salaries

for management employees at levels that it

believes are sufficiently competitive with salaries

paid to management with comparable

qualifications, experience and responsibilities at

companies of comparable size, operational

complexity and businesses to us.

Incentive compensation

Incentive compensation consists of two

components: annual bonuses and sales

commissions. Sales commissions are based on sales

events and are measured on the basis of asset

accumulation, asset retention, or anticipated

revenue from contracted sales, generally taking

into account related factors, such as expected

profit margins. Executive officers participate only

in the annual bonus program and do not participate

in sales commission plans.

Annual bonuses are determined through a process

overseen by the Board and the Committee. Each

individual who participates in the plan is assigned a

target compensation award which may change

from year to year, but generally is the same as

that individual’s prior year target amount. In the

case of executive officers, the target amount is

generally between 120% and 235% of the officer’s

base salary, reflecting the determination of the

Committee to emphasize performance-based

incentive compensation over fixed compensation.

The Committee’s process for allocating incentive

compensation as follows:

•determining the aggregate amount of all

individual target compensation awards for that

year as input into establishing an overall

incentive pool that may be paid out if an EPS

target is achieved; and

•early in the year in question, identifying:

•key business metrics, the Company’s sales

and a range of EPS (the “Quantitative

Performance Metrics”); and

28 2025 Proxy Statement

•indices of success against executing on

management-defined strategic and tactical

objectives for the Company as a whole and

individual market and business units (the

“Qualitative Performance Metrics”),

in each case, for the year that may be considered

in determining what percentage of that overall

pool will be paid in the particular year;

•near the end of the particular year, based on the

Quantitative and Qualitative Performance

Metrics (together, the “Performance Metrics”),

the Committee establishes the overall maximum

incentive compensation pool for that year;

•the Committee then apportions the resulting

overall actual incentive compensation pool

among the market and business units based on

the Committee’s subjective assessment of the

degree to which each unit contributed to our

overall success in each of the Performance

Metrics for that year; and

•the management teams of each of our market

and business units takes the aggregate amount of

incentive compensation allocated to the unit by

the Committee and awards individual bonuses to

employees within those units based upon such

management’s assessment of each individual’s

contribution to the achievements of those units,

as well as each individual’s personal

achievements.

The Committee’s assessment is performed for two

different pools:

•each of our executive officers individually; and

•all employees other than executive officers, as a

group.

When the Committee evaluates business units and

executive officers for the purpose of making

compensation decisions, it meets with our PEO and

reviews a number of factors including:

•our PEO’s evaluation of the units and each of the

individual executive officers;

•the Performance Metrics established at the

beginning of each year to provide a basis for

assessment of performance for these units and

those executive officers who are primarily

responsible for the performance of such units;

•performance against the prior year’s actual

Performance Metrics and other annual goals that

are considered within the overall business

environment of that year;

•achievement of strategic and operating results;

and

•in the case of the individual executive officers:

•their success in their management

responsibilities generally;

•achievement of strategic and tactical goals

of the market or business unit for which they

are responsible;

•achievement of any personal strategic or

tactical goals that may have been

established for the individual employee; and

•the degree to which the individual employee

supported or contributed to, our overall

corporate success.

When the Committee makes decisions regarding

equity or non-equity incentive compensation, it

exercises independent business judgment. There is

no specific formula the Committee applies when

considering the factors that the Committee

believes are important to the assessment of any of

our market or business units’ performance or that

of any individual executive officer or our PEO, nor

does the Committee attach any specific weighting

or priority to the factors it considers.

Consequently, there is no direct correlation

between any particular performance measure and

the resulting equity or non-equity incentive

compensation awards. The Committee believes

that compensation decisions should not be

formulaic, rigid or focused on the short-term.

Equity grants

Our annual equity grants consist of stock options

and RSUs. The Committee believes these grants are

an important means of aligning the interests of

management and employees with the interests of

our shareholders. All of our outstanding stock

options have performance-based vesting

provisions:

•those year-end stock options granted in

December 2024 vest on the later of (a) the

second anniversary of the date of the grant, and

(b) the date on which the Company achieves

adjusted earnings per share (calculated as the

quotient of (x) the Company’s calendar year

income before income taxes (as set forth in the

Company’s Form 10-K as filed with the Securities

and Exchange Commission in the relevant year)

adjusted to not include any reduction for ASC

718 Accounting for Share-Based Compensation

29 2025 Proxy Statement

related to stock options only, divided by (y) the

Company’s diluted shares then outstanding) that

is equal to or greater than an amount that is 25%

or more than the Company’s adjusted earnings

per share (calculated in the same manner as in

the previous clause (x)) as of the end of the year

in which the grant was made; and

•those stock options granted prior to 2024 vest at

a rate of 50 percent when a specified pre-tax

earnings-per-share target is achieved, and the

remaining 50 percent when a second, higher

specified pre-tax earnings-per-share target is

achieved.

Prior to 2017, there was no minimum time-based

factor in the vesting of our stock options.

Beginning in 2017, the Committee changed the

vesting thresholds from an earnings per share

target to a pre-tax earnings per share target, and

it also implemented minimum time periods for

vesting. In 2022, the Committee introduced RSUs

as an element of annual equity compensation

awards.

Our annual RSU awards generally “cliff vest” on

the third anniversary of the date of the grant.

Other than in the case of executive officers, the

annual grants of options and RSUs to employees is

standardized across the Company and based upon a

tier system with the mix of the options and RSUs in

favor of options in the higher tiers.

Annual equity awards are generally determined by

the Committee in December of each year. Our PEO

reviews with the Committee the grants for each

executive officer, other than himself, as well as

the grants for the other employees. The

Committee then deliberates and establishes the

specific option grants and finally submits these

option grant amounts to the entire Board for

ratification.

timing the release of the Company information

around the grant dates of options or other equity

awards, and we have not timed the disclosure of

occasion, we grant equity awards outside of our

annual grant cycle for new hires, promotions,

recognition, retention or other purposes. These

“off cycle” awards are granted only on a limited

2024 Committee actions and

awards

Industry benchmarking

In its deliberations regarding compensation, the

Committee considered the annual analysis of

fintech and asset management industry

compensation trends undertaken for the

Committee by the Consultant.

Review of compensation practices

In January 2024, the Committee began a review of

compensation practices and the elements of our

equity compensation program. The Committee

worked with our Compensation Consultant