PRESENTATION

Published on July 5, 2017

SEI Acquisition of

Archway Technology

Partners

July 5 2017

Exhibit 99.2

Safe Harbor Statement

This presentation includes forward-looking statements that are based on the current expectations of the management of

SEI and are subject to uncertainty and changes in circumstances. The forward-looking statements contained herein

include statements about the expected effects on SEI of the proposed acquisition of Archway, anticipated earnings

enhancements, synergies, and other strategic options and all other statements in this presentation other than statements

of historical fact. Forward-looking statements include, without limitation, statements typically containing words such as

“believes”, “plans”, “projects”, “forecasts”, “may”, “should”, “intends”, “expects”, “anticipates”, “targets”, “estimates” and

words of similar import. By their nature, forward-looking statements are not guarantees of future performance or results

and involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the

future.

There are a number of factors that could cause actual results and developments to differ materially from those expressed

or implied by such forward-looking statements. These factors include, but are not limited to, the inability to integrate

successfully Archway within SEI; the continuation of satisfactory arrangements with Archway’s customers, prospects,

management and employees, exposure to potential litigation and changes in anticipated costs related to the acquisition of

Archway or the conduct of its business. Additional factors that could cause actual results and developments to differ

materially include, among others, the state of the economy and the financial services industry, and the other potential

factors that could affect SEI as described in its filings with the Securities and Exchange Commission, including, but not

limited to, its Annual Report on Form 10-K for the fiscal year ended December 31, 2016. SEI undertakes no obligation to

update or revise forward-looking statements, whether as a result of new information, future events or otherwise. Forward-

looking statements only speak as of the date on which they are made.

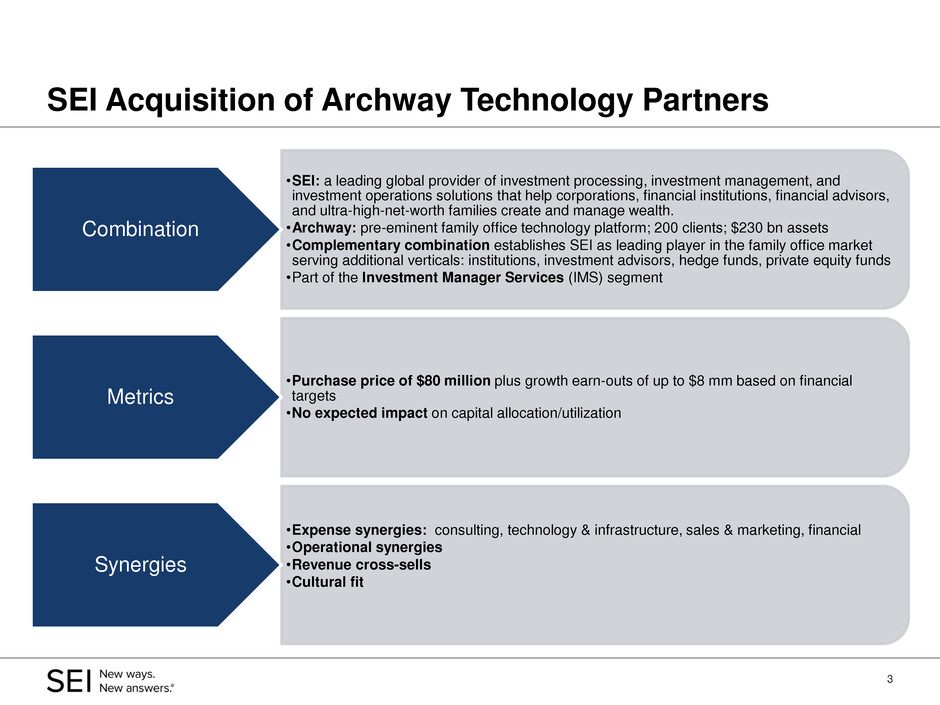

•SEI: a leading global provider of investment processing, investment management, and

investment operations solutions that help corporations, financial institutions, financial advisors,

and ultra-high-net-worth families create and manage wealth.

•Archway: pre-eminent family office technology platform; 200 clients; $230 bn assets

•Complementary combination establishes SEI as leading player in the family office market

serving additional verticals: institutions, investment advisors, hedge funds, private equity funds

•Part of the Investment Manager Services (IMS) segment

Combination

•Purchase price of $80 million plus growth earn-outs of up to $8 mm based on financial

targets

•No expected impact on capital allocation/utilization

Metrics

•Expense synergies: consulting, technology & infrastructure, sales & marketing, financial

•Operational synergies

•Revenue cross-sells

•Cultural fit

Synergies

SEI Acquisition of Archway Technology Partners

3

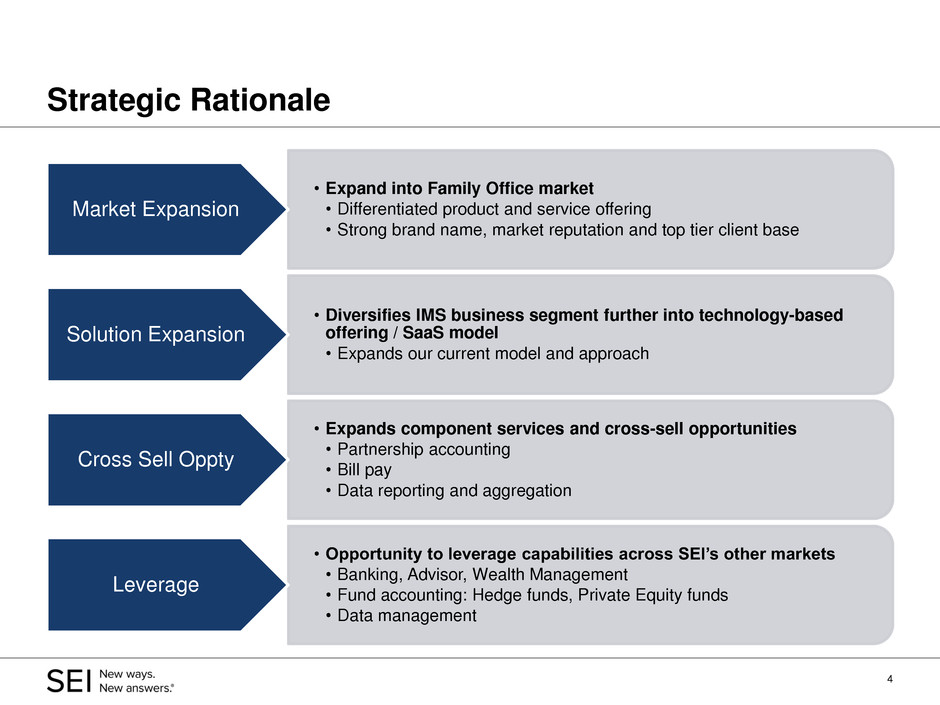

• Expand into Family Office market

• Differentiated product and service offering

• Strong brand name, market reputation and top tier client base

Market Expansion

• Diversifies IMS business segment further into technology-based

offering / SaaS model

• Expands our current model and approach

Solution Expansion

• Expands component services and cross-sell opportunities

• Partnership accounting

• Bill pay

• Data reporting and aggregation

Cross Sell Oppty

• Opportunity to leverage capabilities across SEI’s other markets

• Banking, Advisor, Wealth Management

• Fund accounting: Hedge funds, Private Equity funds

• Data management

Leverage

Strategic Rationale

4

Archway At-a-Glance

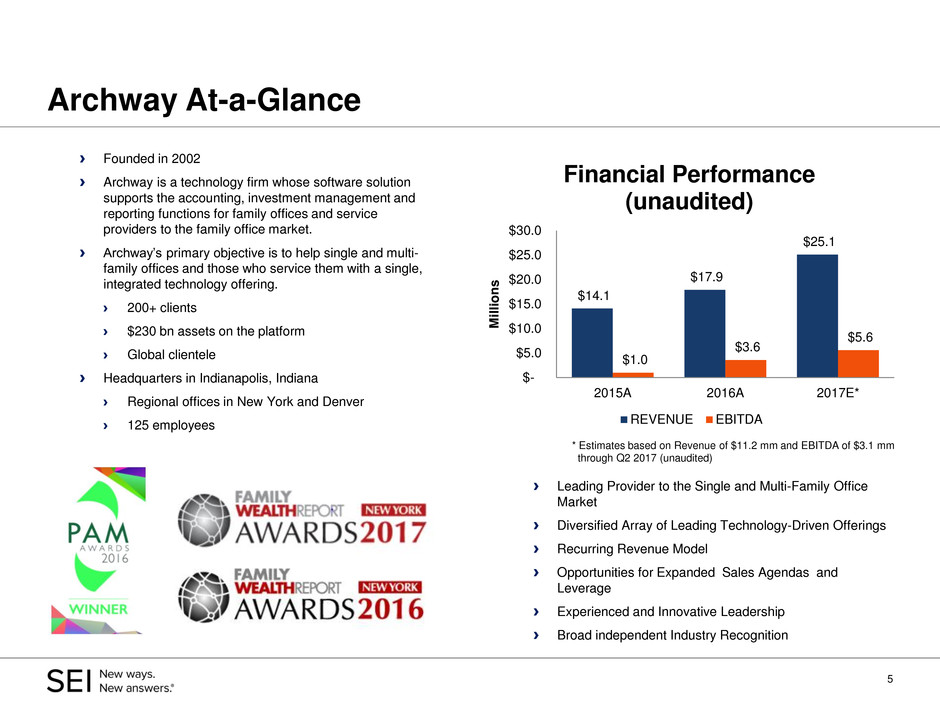

› Founded in 2002

› Archway is a technology firm whose software solution

supports the accounting, investment management and

reporting functions for family offices and service

providers to the family office market.

› Archway’s primary objective is to help single and multi-

family offices and those who service them with a single,

integrated technology offering.

› 200+ clients

› $230 bn assets on the platform

› Global clientele

› Headquarters in Indianapolis, Indiana

› Regional offices in New York and Denver

› 125 employees

5

› Leading Provider to the Single and Multi-Family Office

Market

› Diversified Array of Leading Technology-Driven Offerings

› Recurring Revenue Model

› Opportunities for Expanded Sales Agendas and

Leverage

› Experienced and Innovative Leadership

› Broad independent Industry Recognition

$14.1

$17.9

$25.1

$1.0

$3.6

$5.6

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

2015A 2016A 2017E*

M

ill

io

n

s

Financial Performance

(unaudited)

REVENUE EBITDA

* Estimates based on Revenue of $11.2 mm and EBITDA of $3.1 mm

through Q2 2017 (unaudited)

Financial Impact

› Purchase price: $80 million with additional growth earn-outs (of up to $8

million) based on specific financial targets

› Amortization of intangible assets of approximately $50 million over 5 years

› Partially offset by expected short-term expense synergies of at least $2 million

› Longer-term growth opportunities

› Growth in existing client base

› Cross selling to Archway clients and SEI clients

› Small/Start-up hedge and private equity managers

› Additional functionality for other SEI segment clients

6